As people settle into 2022 and observe the current trends in the economy – one thing becomes clear: it is more important now than ever to minimize costs and maximize your tax deductions if you’re self-employed, running a small business, or an independent contractor. If you fall into one of these categories and you drive a car for work, getting upwards of $12,000 in tax deductions can be life-changing.

That’s why you need to track both your personal and business mileage with a mileage tracking app – old techniques such as using Excel or even a paper-based mileage logbook are time-consuming and cumbersome. With a wealth of great apps available on the market, finding the best mileage tracker app is a tough job.

There’s what’s popular and there’s what’s good – features play the biggest role here. Today we’re going to delve into an overview of those features in the wider market, highlighting the most promising and useful providers in the process.

Obtaining a mileage tracking app

Luckily, the great majority of apps are available for both Apple devices and Android gadgets – they can be downloaded via Google Play Store and App Store, along with their various add-ons. Most apps offer very little without you using your credit card, meaning you might just have to dip into your bank account to get the features that are the most desirable – not in all cases, though.

Pricing plans and free mileage tracking

Serious business owners usually opt for a monthly plan which ranges between $5 and $15, depending on the software provider and the plan the user chooses. However, it is worth noting that many providers offer free versions with drawbacks, such as a limit of 30 or 40 trips per month, or manual trip input without auto-tracking, as is the case for TripLog.

Only one company offers a full version with a limited trial period of 14 days – MileageWise. This includes all of their features, though if you are just starting out as an independent contractor, you may be fine with only 30 trips per month, which is achievable through Everlance’s app among others.

How to keep track of mileage for taxes

Let’s talk a little about the IRS. There are some basic requirements that must be met when it comes to preparing and submitting a mileage log to them. Let’s take a look at these:

- You need to take note of your odometer readings at the beginning and end of the tax year. This way you can prove the mileage you’ve done.

- The distance of each trip you’ve completed. You can log these manually or, with some apps, the software may have various auto-tracking features that help it differentiate between your trips.

- The purpose of each trip you’ve recorded, along with its departure point and corresponding arrival point.

- If you use your car during work hours for work-related tasks and personal errands, you should record all these trips. The IRS wants these numbers as they connect directly to your odometer readings – and, the IRS considers anything less than 10% of your mileage as personal to be strange – an anomaly – most mileage logs stipulate at least 10% of their total as personal. This is especially important when you consider the increased possibility of the IRS auditing people who seem to fall outside the expected norms of what a mileage log should look like.

With these requirements in mind, let’s take a closer look at what features could prove most valuable when it comes to you maximizing your time – no one wants to be bogged down by tedious and unnecessary administration when they can avoid it! That’s why all the best apps offer features that reduce the input you put in while simultaneously optimizing the output you get from those activities.

The mileage tracker app features you are going to need

Let’s take a look at some typical features which are essential when choosing what mileage tracker app to use, along with rarer features that only certain providers offer.

Manual trip recording

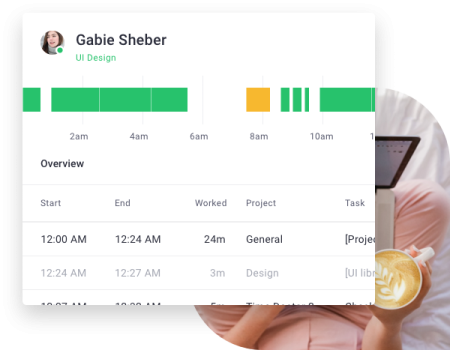

While it would seem an obvious feature to include in all apps, some do not offer manual tracking. Manual tracking allows users to input the details of any trips they make, along with the purpose of those trips. Modifying the details of any trips can also be quite important, and most providers give you a web dashboard where this is possible. People often use an app’s accompanying web dashboard to tinker with any details that might have been missed or to input yearly or monthly odometer readings.

Moreover, if you find yourself under the gun preparing for an IRS audit – making sure your logs are accurate and ready for submission to the IRS is absolutely essential.

Auto-tracking

Only a few providers have robust tracking features – namely, MileageWise and TripLog. Both offer Plun’N’Go auto-tracking with your phone, which means that provided your phone is plugged in and your vehicle starts moving, the app records your trip until you stop at your next destination and unplug your phone – double trigger point. MileageWise’s app also auto-fills the finer details of your trip depending on its origin and arrival point, as the app contextualizes the purpose of your trip based on a number of factors.

In addition to this more traditional auto-tracking method, both companies also offer Bluetooth tracking, which is often more convenient and easier to use if you find yourself already using Bluetooth during work hours.

In-Built IRS auditing

One of the newer and more exciting additions to the apps in this market is MileageWise’s in-built IRS auditor – this feature checks your logs, your odometer readings, and all other relevant parameters in order to make sure that when you submit your log, everything is kosher and IRS-proof. In total the revolutionary app checks more than 70 logical conflicts when assessing if your mileage log is ready for submission to the IRS – which, sadly, the other market players do not provide. This feature is absolutely essential if you have a personal business and want to avoid any fines that could impact your business severely.

A snapshot of the Industry’s top apps

Having taken a look at what some of the industry’s best provide in terms of features – let’s take a look at a wider overview of the market, where we can see what both the most popular and best mileage tracker app providers offer:

As we mentioned earlier – popularity doesn’t always translate to competence, as we can see with this chart. Some of the most popular software providers don’t offer certain features, while others – namely MileageWise – have a host of features that are pushing the envelope.

It’s also worth mentioning the tax deductibles that each company’s users enjoy – these reflect not only the apps and their competence but also the types of users who prefer one app over another.

If you’re serious about your business expenses, it’s hard not to notice that a user base that enjoys average business mileage deductions of $12,000 is one to look out for.

Give what many are saying is the industry’s best mileage tracker app a go today – MileageWise is free with all of its features for 14 days – and long term, the app’s features make it a strong go-to when you’re looking for drama-free mileage logging.