Keeping a ledger is one of the most important aspects of running a business. It allows you to track your income and expenses, which is crucial for both tax purposes and making sure your business is profitable. While there are many different ways to keep a ledger, knowing how to create a business account ledger is essential for any startup. Below is a guide on how to go about it.

Set Up a Business Ledger Accounts

The first step is to set up a business ledger account. This can be done by going to your local bank and asking to open a business account. Have all the required documentation, such as your business license, ready before you go. Once you have opened the account, you will need to deposit money into it. The amount you deposit will depend on the size of your business and your projected expenses.

Using accounting software is the best way to keep track of your business ledger. This will allow you to automatically categorize transactions and keep track of your expenses without manually entering them into a spreadsheet. FreshBooks is one of the most popular options for small businesses

Once you have set up your business ledger account and deposited money, you need to start categorizing your transactions. The most common categories in business ledgers are income, expenses, assets, and liabilities. You can add or remove categories as needed, but these are the basics that all businesses should track.

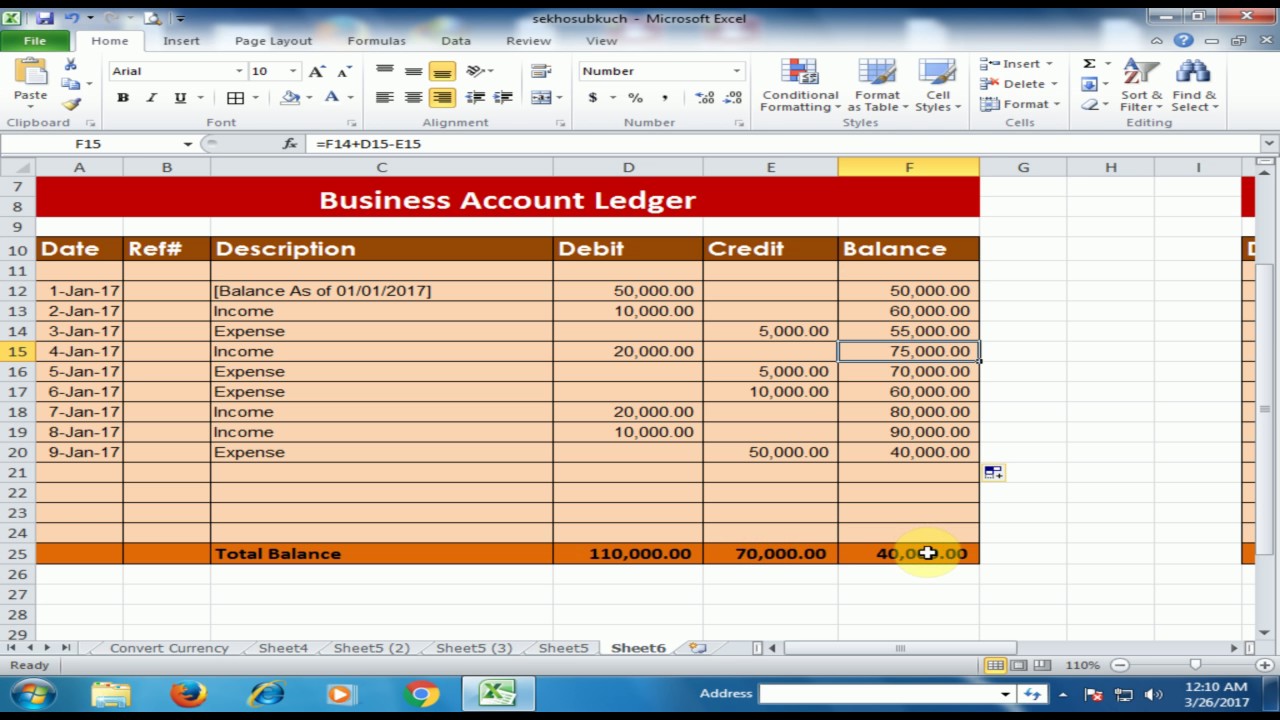

Create Columns

The next step is to create columns for each account type in your ledger. This will allow you to track all the money coming in and going out of your business. To do this, simply label the first column “account type” and the second column “amount.” Then, fill in the appropriate information under each column. For the account type column, you will need to write out each of the five account types: liability, assets, income, expenses, and equity.

After you have created the columns, you will need to fill in the information under each column. This is where a balance sheet template can be extremely helpful. A balance sheet template will provide you with all the information you need to fill in your ledger. Simply enter the relevant information into the template and then transfer it to your ledger.

Transfer Transactions from Journal To Respective Ledger Account

The third step is to transfer all of the transactions from your journal into the respective ledger account. To do this, simply go through each transaction in your journal and find the corresponding ledger account. For example, a debit account of the journal is posted on the debit account of the ledger account. Once you have gone through all of the transactions in your journal, you will need to total up each column. This will give you the balance for each account type.

Number The Transactions

The fourth step is to number the transactions in your ledger. This will help you keep track of all the money coming in and going out of your business. Simply go through each transaction in your ledger and number it accordingly. Ensure to put the transaction date next to the number so you can easily track it.

Balance The Ledger

After filling the columns and numbering them, balance your ledger. This will ensure that all the money in your business is accounted for. To balance your ledger, simply add up all the money in each account and compare it to the total amount of money in your business. You will need to investigate where the missing money is if there is a discrepancy. The account ledger, therefore, becomes a tool not just for tax purposes but to ensure your business is running smoothly.

Folioing

The final step is to folio your ledger account. This simply means that you will need to put all of the information from your ledger account into a folio. A folio is a bound collection of sheets, usually of paper, fastened together along one edge. To do this, simply take all of the information from your ledger account and transfer it to a folio. Include the date, account type, description, and amount for each transaction. Once you have transferred all of the information from your ledger account into the folio, you are finished!

By following these steps, you can create a business account ledger for your startup. This will allow you to track all the money coming in and going out of your business. Doing this will help you ensure that your business is running smoothly and that all your finances are accounted for. So, what are you waiting for? Get started today!