Unit Linked Insurance Plans (ULIPs) stand out as a versatile option in India. Combining the dual benefits of insurance and investment, ULIPs serve as an excellent savings plan for those looking to secure their future while maximising their wealth. However, the key to truly benefiting from ULIPs lies in understanding their potential returns, and this is where a ULIP return calculator becomes indispensable.

ULIPs offer a unique blend of security and growth, making them a preferred savings plan for many. They allow policyholders to invest in a range of assets like stocks, bonds, or a combination of both, while also providing life insurance coverage. This dual feature ensures that while you grow your wealth, your loved ones’ future is also secured.

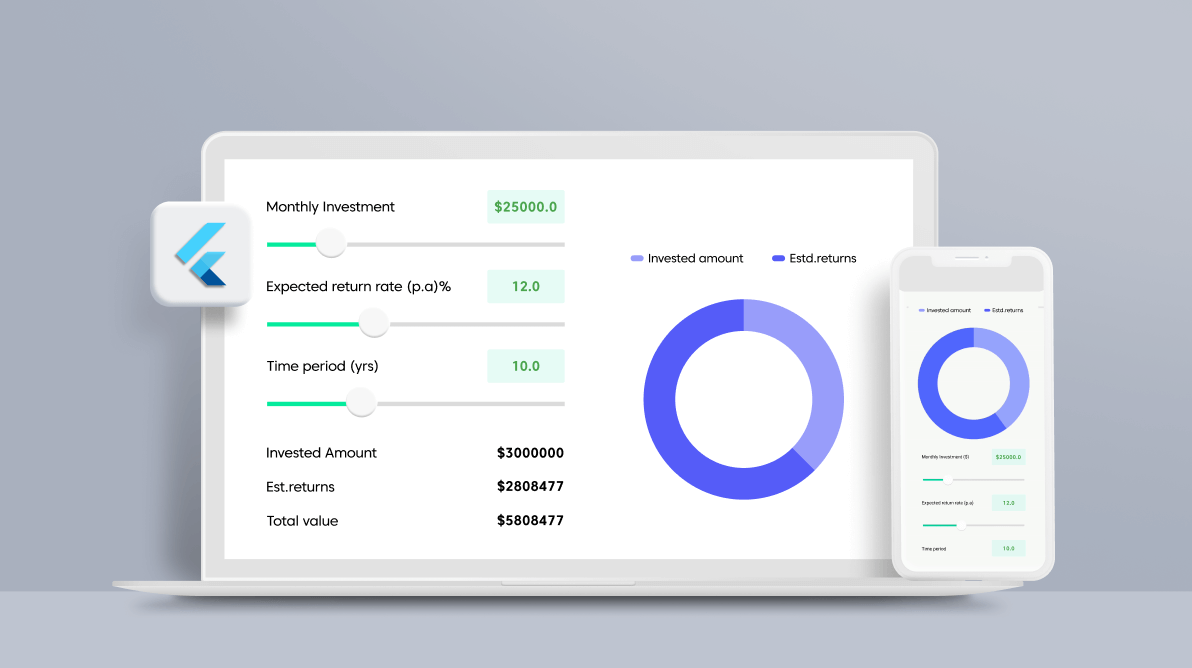

Reasons to use a ULIP returns calculator

Investment planning

It plays a crucial role in deciding how much to invest, for how long you must stay invested and your savings plan. The calculator shows how different investment tenures and amounts can impact the final corpus, allowing you to align your investments with your financial capacity and goals.

Goal setting

The ULIP return calculator aids in establishing realistic financial goals. By inputting various parameters like investment amount, tenure, and expected rate of return, you can gauge what to expect in terms of future value. This process helps in setting achievable targets, whether it’s for children’s education, buying a house, or any other long-term objective.

Risk assessment

Different ULIP funds come with varying degrees of risk and potential return. The calculator helps you understand this trade-off by simulating the outcomes of different fund options, thus guiding you in selecting a fund that matches your risk appetite.

Return estimation

It offers an estimated return projection depending on past data. This benefit is crucial for forecasting how much your investment may increase, factoring in distinct market conditions as well as investment choices.

Cost analysis

ULIPs include charges such as fund management fees, mortality fees and policy administration fees. The return calculator assists in better understanding how such expenditures can impact your investments over time, ensuring there are zero surprises later on.

Tax planning

ULIPs endow tax advantages as per Section 80 C and 10 (10D). The return calculator can help in estimating your tax liability under distinct investment scenarios, helping in effective planning for tax.

Portfolio optimisation

By utilising the online calculator, you can better adjust your portfolio for better returns, ensuring your investments remain always optimised, yielding the best possible returns.

Performance tracking

The ULIP performance over time can differ. The online calculator assists in tracking the ULIP performance, permitting you to make better decisions if you should stick to the existing funds or consider availing of other options.

Inflation adjustment

Inflation can erode the real value of your returns. The ULIP return calculator can factor in inflation to show you the real worth of your future returns, helping in planning investments that beat inflation.

Flexibility analysis

ULIPs provide the flexibility to simply switch between funds. With the online calculator, you get to know the potential advantages of switching funds based on your risk tolerance level and market conditions.

Comparison tool

This instrument allows you to compare distinct ULIP plans depending on distinct factors such as features, charges and anticipated returns, assisting you select the best plan well-suited to match your requirements.

Insurance coverage estimation

Deciding the correct insurance policy is essential. The online calculator assists in estimating how much coverage you require, ensuring your policy constituent is not only an add-on but a considerable part of your planning.

Retirement planning

Planning for retirement requires understanding how much you need to invest today to achieve your desired retirement corpus. The calculator aids in this planning by projecting future returns based on your current investments.

Scenario analysis

It allows you to analyse various investment scenarios under different market conditions. This feature is particularly useful in understanding how your investments might perform in bullish or bearish markets.

Liquidity analysis

Understanding the liquidity aspect, like partial withdrawals and fund liquidity, is crucial. The calculator provides insights into how these features impact your overall returns and financial flexibility.

Ways to effectively use the ULIP returns calculator

Input accurate data.

When utilising a ULIP return calculator, the accuracy of input data is critical. This entails carefully inputting information such as the amount you intend to invest, the term of your investment, your present age, and your risk tolerance. For example, a larger investment amount or a longer investment period might drastically affect the predicted returns. Similarly, your age can impact the type of funds you select, and your risk tolerance influences the proportion of equity and debt components in your portfolio. Accurate inputs are critical since they form the foundation of the calculator’s estimates, influencing decisions about how much and where to spend.

Investment periods vary

The duration of your investment is essential in determining the possible earnings on a ULIP. The calculator allows you to experiment with different investment tenures to observe how short-term vs long-term investments affect fund growth. This activity assists in matching your investment with long-term goals such as retirement planning or children’s education, where compounding plays an important role. lengthier investment durations often result in better returns owing to compounding, but they also need a lengthier commitment of capital.

Evaluate several fund possibilities.

ULIPs provide a variety of fund alternatives, each with its unique risk and return profile. Equity funds are riskier but possibly more profitable, whilst debt funds are more conservative, providing consistent but typically smaller returns. Balancing these alternatives according to your risk tolerance is critical. The ULIP return calculator lets you see how different fund compositions affect prospective returns. This assessment is crucial for personalising your investment to your risk tolerance while seeking the highest potential returns.

Consider market movements

While ULIP return calculators provide estimates based on past data, they cannot forecast future market circumstances. The actual performance of your investment may differ owing to market volatility. As a result, when using the calculator, remember to consider current market trends and economic situations. Consider market cycles, economic projections, and political stability, which all have a big influence on market performance. This understanding can assist you in setting reasonable expectations and preparing for any market fluctuations.

Final thoughts

A ULIP return calculator is more than a tool; it’s a road map for your financial future. By successfully utilising it, you may make educated decisions that are consistent with your financial objectives, risk tolerance, and investment horizon. Remember that making educated financial selections leads to better savings and a more secure future.